2023 unemployment tax calculator

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

Get a head start on your next return.

. Take a look at the base period where you received the highest. Begin tax planning using the 2023 Return Calculator below. In case you have any Tax Questions.

Based on the Information you. This taxable wage base is 62500 in 2022. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years.

Unemployment insurance FUTA 6 of an. 5000000 the rate of income tax is Rs. Sign up for a free Taxpert account and e-file your returns each year they are due.

Where the taxable salary income exceeds Rs. This Estimator is integrated with a W-4 Form Tax withholding feature. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

This is your total income subject to self-employment taxes. Usually your business receives a tax credit of up to. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. The standard FUTA tax rate is 6 so your max. The Unemployment Insurance Fund UIF is a system that gives.

Today employers must pay federal unemployment tax on 6 of each employees eligible wages up to 7000 per employee. The ranges are wide. It can also be used to help fill steps 3 and 4 of a W-4 form.

Kentuckys range for example is 03 to 9. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 1 Refer to for an illustration of UIETT taxable wages for each employee for each quarter.

Work out your base period for calculating unemployment. Refer to Reporting Requirements. For Wages Employers Paid in 2021.

State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. Each state also decides on an annual SUTA limit so that an.

To calculate the amount of unemployment insurance tax. 2021 Tax Calculator Exit. An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes.

To calculate your weekly benefits amount you should. Each state decides on its SUTA tax rate range. 3500000 but does not exceed Rs.

Calculate Your 2023 Tax Refund. Contact a Taxpert before during or after you prepare and e-File your Returns. California employers fund regular Unemployment Insurance UI benefits through contributions to the states UI Trust Fund on behalf of each employee.

2 This amount would be reported on the appropriate reporting form. 370000 20 of the amount exceeding Rs.

2022 Income Tax Brackets And The New Ideal Income

What Is The Bonus Tax Rate For 2022 Hourly Inc

Doing Business In The United States Federal Tax Issues Pwc

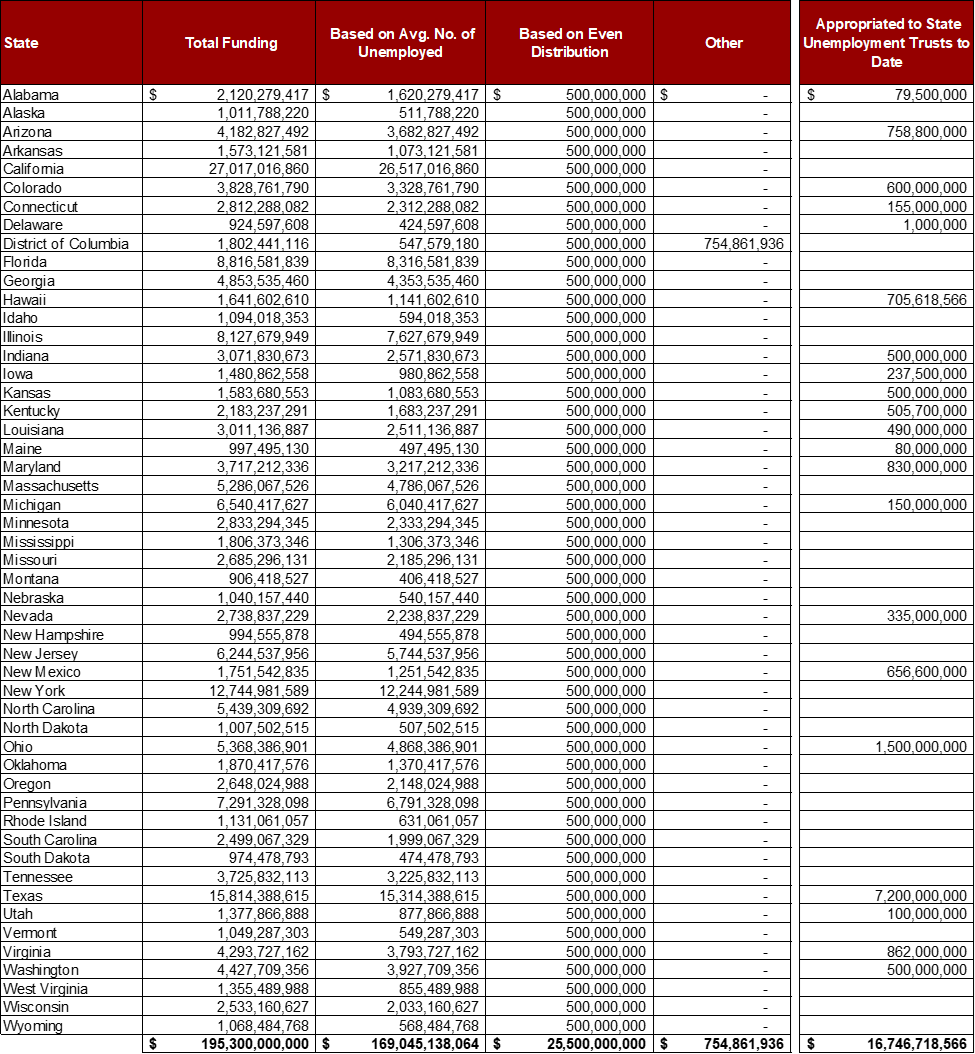

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

C2fko6meji F6m

View All Hr Employment Solutions Blogs Workforce Wise Blog

Jmadj7dfmfigtm

Simple Tax Calculator For 2022 Cloudtax

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Corporation Tax Europe 2021 Statista

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Llc Tax Calculator Definitive Small Business Tax Estimator

2022 Federal State Payroll Tax Rates For Employers

View All Hr Employment Solutions Blogs Workforce Wise Blog